Category Tutorial – Biscuits

The biscuit category should be core to every food and snack offer as the category is

purchased by nearly every household. Biscuits splits into 2 shopper missions ‘Take

home’ and ‘on-the-go’

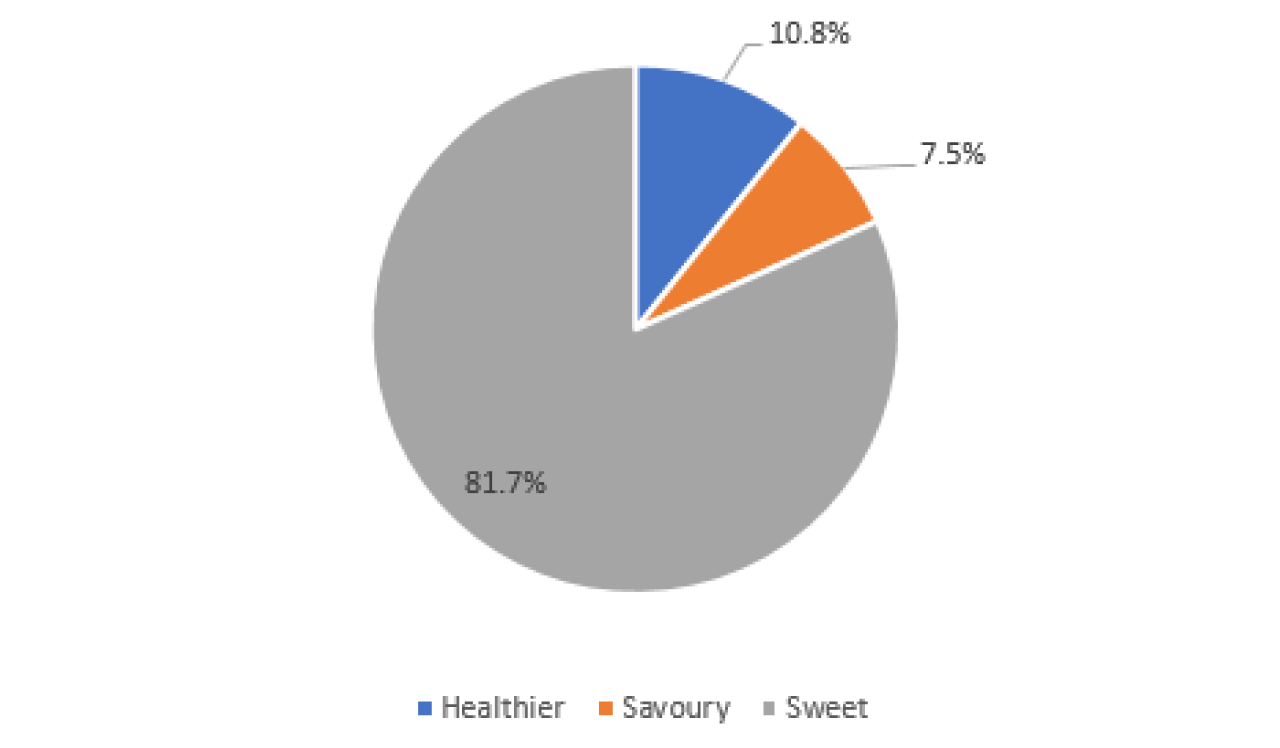

The category has 3 segments: Healthier*, Sweet, Savoury

Biscuit Market Segments in Independents and Symbol Stores1

Top brands include McVities , Cadbury , Oreo, Ritz, belVita

Whilst the sweet biscuit segment is the largest segment, Healthier biscuits and snack bars* have seen the highest % growth of over the last year.1

Healthier Biscuits within Indies & Symbols have grown 23.6% value sales, well ahead of Total Market and Grocery Convenience.2

Take Home biscuits

Take Home Biscuits make up 87% of sales…, and biscuits sales are growing 25% YTD.2

Value is key to these shoppers

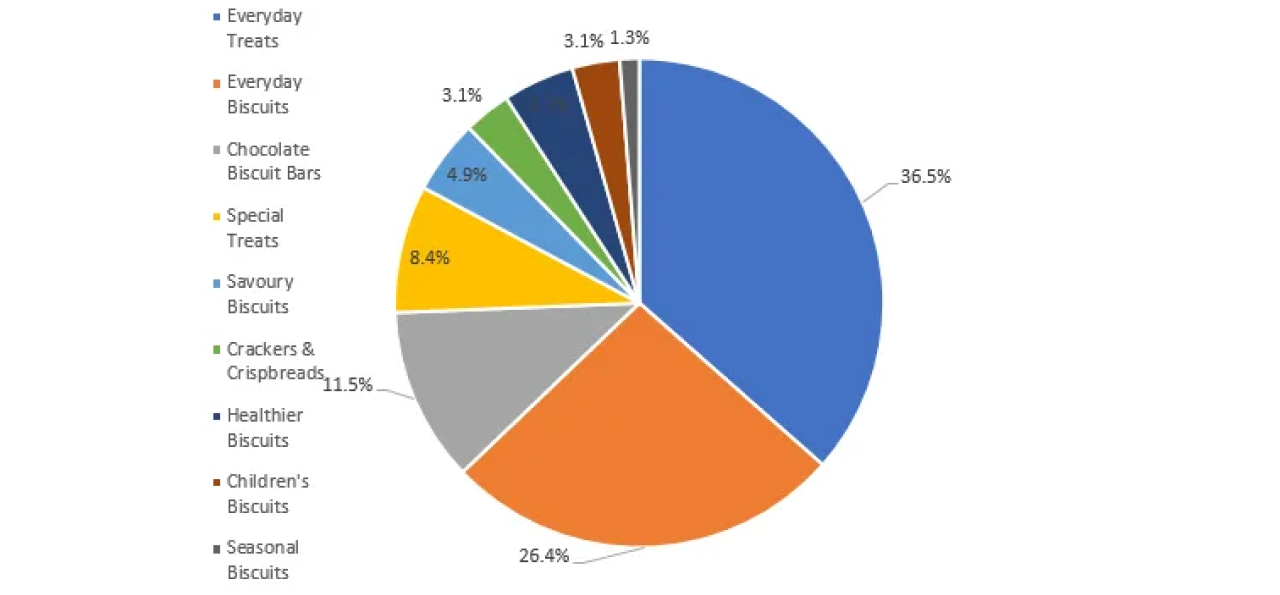

Take Home biscuits further segment as the chart below shows. Sweet Everyday

Treat biscuits and everyday biscuits make up over 60% of sales.

Recommendations

Focus on everyday biscuit, Everyday treats biscuits

‘Healthier biscuits* are in growth so it’s recommended to include these in the range with a selection of savoury top sellers

Consider stocking price marked packs³ as well as chocolate biscuit bars

On-the-go biscuits

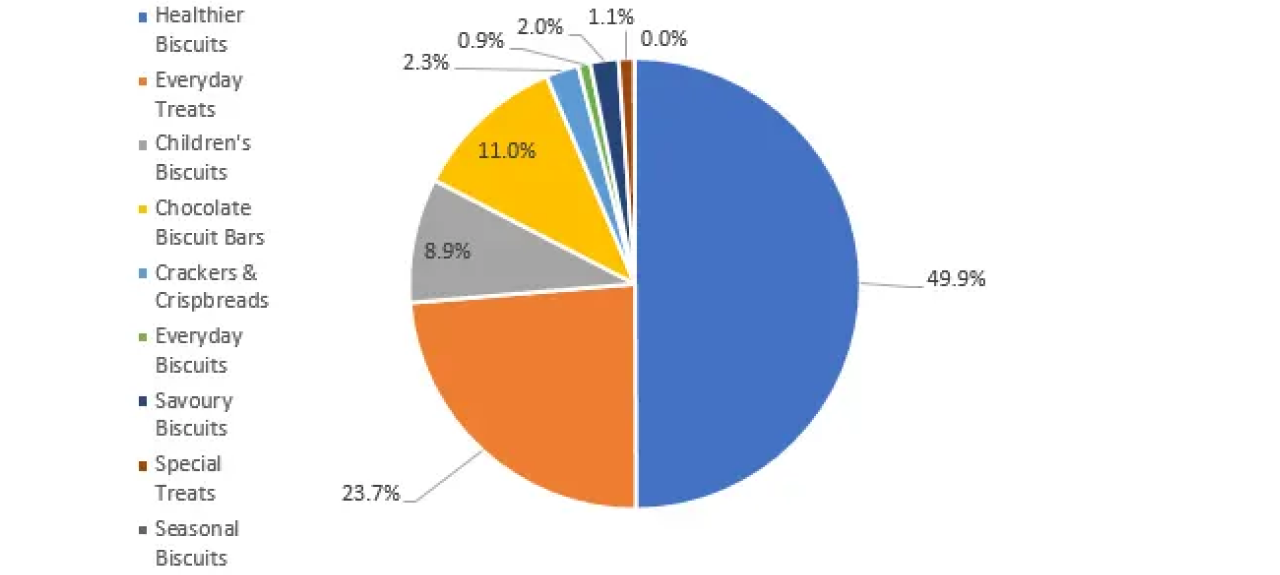

On- the- go biscuits are a key driver of growth for stores². Shoppers of these products tend to be younger and often look to trade up. The growing trend in the market towards healthier eating is reflected in on the go biscuits with 53%² of on- the -go biscuit Sales being healthier biscuits*.

On the Go Biscuits Sales by Segment2

Recommendations

Focus on ‘Healthier biscuits‘ in your on-the-go range

Have a range of products price points to offer trade up option for shoppers

Consider stocking price marked packs³ as well as chocolate biscuit bars

¹ Source : Nielsen, Mdlz Indies & Symbols, Value Sales (£), YTD w/e 15.7.23.

² Nielsen, Indies and symbols, value sales 15.7.23

³ Retailers are free to set their own prices. Non price marked packs available

*Heathier as defined by Nielsen