Tutorial - Confectionery

Confectionery is one of the biggest food and drink categories in convenience and it’s also one of the most impulsive categories¹.

It’s also a key category in your store because confectionery shoppers drive spend in stores with bigger average basket spends and longer dwell times¹.

Some Shopper facts

33% say confectionery is the reason they are in store²

32% shoppers are on Top-up mission when buying confectionery¹

26% are on a newsagent mission so it’s a good idea to site confectionery by papers and magazines¹

13% of shoppers are on a Food-to-Go mission buying confectionery in meal deals¹

MARKET FACTS

The total confectionery market in Indies and Symbols splits by manufacturers as follows.

Value Share in Indies and Symbols3 | |

|---|---|

Mondelez International | 32.70% |

Mars Wrigley | 20.10% |

Nestle | 13.60% |

Ferrero | 5.40% |

Haribo | 6.50% |

Lindt | 1.50% |

Others | 20.20% |

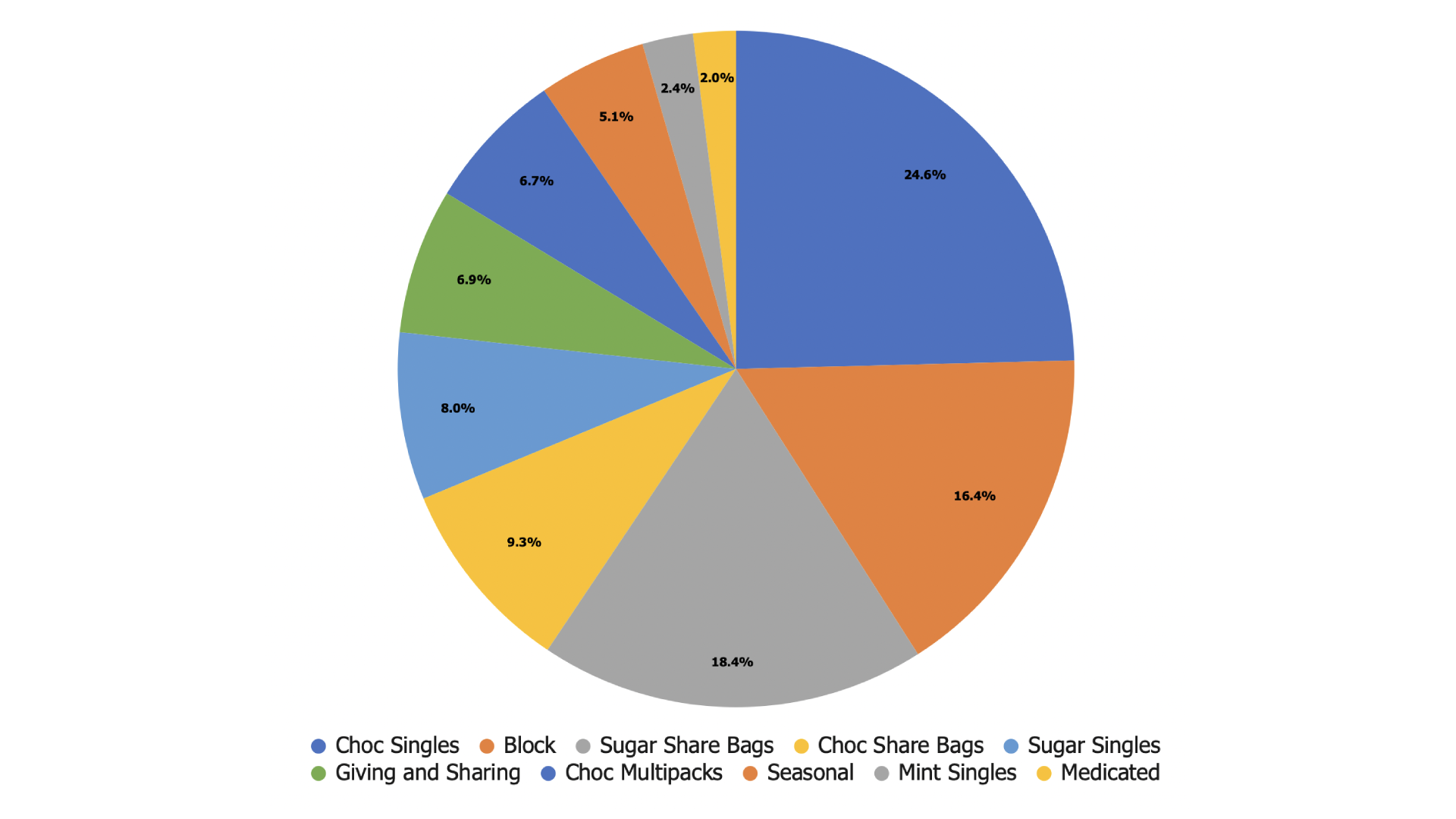

The confectionery market comprises of different formats see below³

Singles

Singles make up a third of Confectionery sales in Indies and Symbols and are highly impulsive.

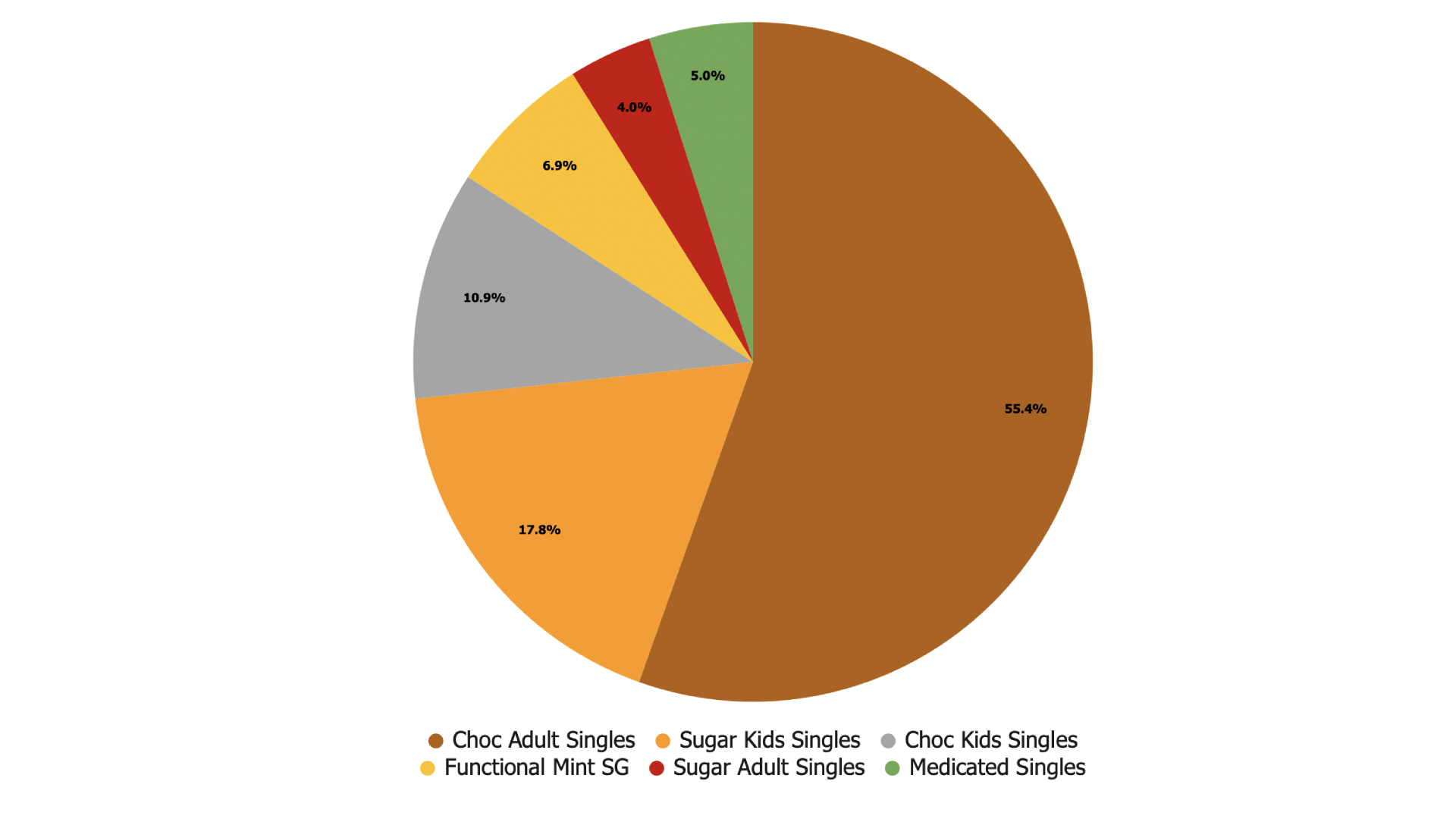

Singles split into subcategories below³:

Some Shopper facts

- 16% of chocolate singles are bought on a food to go mission often with other food items or a drink²

- Brand is the most important reason for purchase in the chocolate singles category²

- Younger shoppers are buying more chocolate singles and have a higher basket spend²

- Duo’s are growing stronger than standard singles so it’s a format to stock³

- Duo’s are most often purchased on a Food to Go mission²

- Almost 50% of singles sales confectionery predominantly purchased for children are purchased in Indies and Symbol store³

- A third of all mints are sold through indies and Symbols stores

- Mints, like gums are consumed to refresh – so it’s key to offer both

- They are often consumed after food and drink

Our recommendations for singles in stores

- Site singles on the main fixture and consider placing near other Food to Go products and merchandising near drinks/coffee machines⁴

- For products predominantly purchased for children clearly display under 100 calorie on pack so shoppers can be reassured

- Stock the best sellers Cadbury has 3 out of the top 10 sellers in Indies & Symbol Stores³

- Stock latest new products and products that are being support with media

- Use eye catching Point of sale

Useful Insight on Relief Candy

Relief candy fulfils a unique need in the Cold and Flu season and Hayfever season

Sales peak in Winter but they sell all year round

It’s important to provide product that both ‘clears and soothes’

Other Useful Insights on Confectionery

Chocolate bags

Perfect for the ‘night in’ ‘shopper mission, bags are a significant % of the confectionery

Sugar bags

Sugar bags account for 61% of all sugar confectionery sales and sales are growing⁵

Night -in is the key shopper mission and 69% of shoppers are female⁶

Much of the growth in Sugar bag sales is from Vegan and Halal approved products⁵

The category offers both ‘soft’ and ‘hard’ textured confectionery, it’s important to stock both

Tablets

A really important and significant sized category

The key shopper mission is ‘night -in’ which is a sharing occasion and the main reason to purchase is ‘treat’

Value is important and this product format is really important to shoppers on a budget or for those planning ahead to have something in the store cupboard

Multi packs

Multi Packs have been growing in Indies and Symbols³

The Multi pack shopper mission is different to singles

- Most are purchased as part of a planned or main shopper mission

- Taste and value most important factors when purchasing

- Therefore we suggest separating multi packs from singles on displays either at base of the main fixture or a designated area

Gifting and sharing

A significant proportion of confectionery is sold for Gifting and sharing.

These products help drive sales value in store, as they tend to have a higher price per weight than standard confectionery and are a growing opportunity as customers shop more locally. There is a demand for gifts and sharing offers all year round, for example gifts for Birthdays and to say thank you.

There are also specific seasons, Christmas and Easter being the largest, and other events and festivals to be tapped into through the year.

Seasons and events are a great way to create theatre in more store and can make a real conversation point! Click here to find out more about winning in the seasons.

For market best sellers list click here

For display advice click here

For planograms click here

¹ Lumina ’21

² Lumina CTP ‘22

³ Nielsen, Value sales Indies and Symbols 26.2.22

⁴ Where HFSS regulations apply on non HFSS products can be display in certain areas of the store

⁵ Nielsen – indies and Symbols, standard candy , value sales , MAT 06/11/21

* Kantar World Panel, total candy bags , 52 wks, w/e 21.03.21